In the realm of small business health insurance plans that promise significant savings, a world of possibilities opens up. Get ready to explore the intricacies and benefits as we delve into a detailed discussion filled with valuable insights.

This guide will shed light on the importance of health insurance for small businesses, cost-saving strategies, employee coverage, legal considerations, and much more.

Overview of Small Business Health Insurance Plans

Health insurance plays a crucial role in ensuring the well-being of employees in small businesses. It provides access to quality healthcare services and safeguards against unexpected medical expenses. When selecting a health insurance plan, small businesses should consider factors such as cost, coverage options, and provider networks to meet the needs of their employees.

Common Types of Small Business Health Insurance Plans

- Health Maintenance Organization (HMO): Offers a network of healthcare providers for employees to choose from and requires a primary care physician.

- Preferred Provider Organization (PPO): Provides more flexibility in choosing healthcare providers, both in and out of the network, but at a higher cost.

- High-Deductible Health Plan (HDHP): Requires employees to pay a higher deductible before insurance coverage kicks in, usually paired with a Health Savings Account (HSA).

Key Factors to Consider When Selecting a Health Insurance Plan

- Cost: Evaluate premiums, deductibles, and copayments to find an affordable plan that meets the budget of the business and its employees.

- Coverage Options: Consider the range of services covered, such as preventive care, prescription drugs, and specialist visits, to ensure comprehensive healthcare benefits.

- Provider Networks: Review the network of doctors, hospitals, and specialists included in the plan to guarantee access to preferred healthcare providers.

- Employee Needs: Take into account the healthcare needs of employees, such as chronic conditions or family coverage, to tailor the plan accordingly.

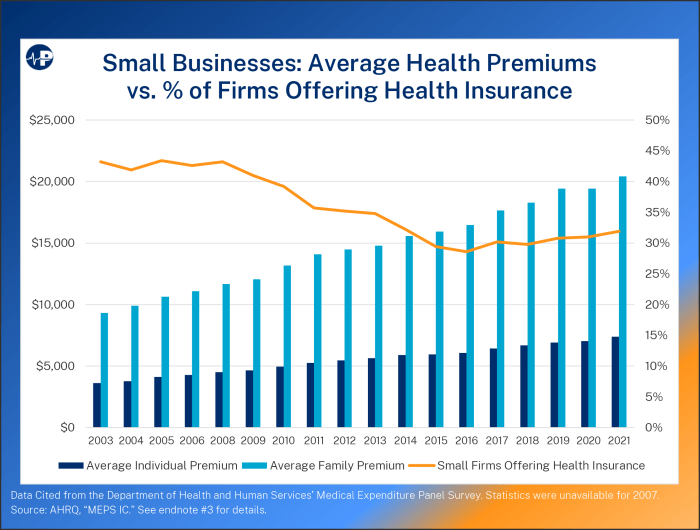

Cost-Saving Strategies for Small Business Health Insurance

When it comes to small business health insurance, finding cost-saving strategies is crucial to managing expenses while still providing essential coverage for employees. Here are some key strategies that small businesses can implement to save on health insurance costs:

Self-Funded vs Fully Insured Health Insurance Plans

Self-funded health insurance plans involve the employer directly funding the healthcare costs of employees, while fully insured plans involve paying premiums to an insurance carrier. Here is a comparison of the cost implications of each:

- Self-Funded Plans: While self-funded plans may have higher upfront costs, they provide more control over healthcare expenses and can lead to significant savings in the long run if claims are lower than expected.

- Fully Insured Plans: Fully insured plans offer more predictability in terms of costs as premiums are fixed, but they may end up being more expensive if claims exceed expectations.

Negotiating with Insurance Providers

Negotiating with insurance providers can be an effective way for small businesses to save on premiums and secure better rates. Here are some tips for negotiating with insurance providers:

- Shop Around: Compare quotes from multiple insurance providers to leverage better rates and coverage options.

- Consider Higher Deductibles: Opting for higher deductibles can lower monthly premiums, but be sure to assess the impact on employees' out-of-pocket costs.

- Wellness Programs: Implementing wellness programs can lead to healthier employees and lower healthcare costs, which insurance providers may reward with lower premiums.

- Customize Coverage: Tailoring coverage to fit the specific needs of your employees can help avoid unnecessary costs and ensure you are only paying for essential benefits.

Employee Coverage and Benefits

When it comes to small business health insurance plans, providing comprehensive coverage and attractive benefits to employees is crucial for both recruitment and retention.

Essential Coverage Options

- Medical coverage for doctor visits, hospital stays, and prescription drugs.

- Dental and vision coverage for preventive care and treatments.

- Mental health coverage for therapy and counseling services.

- Maternity and newborn care for expecting parents.

- Wellness programs to promote healthy habits and prevent illnesses.

Benefits of Wellness Programs

Wellness programs can significantly benefit employees by promoting healthy lifestyles, reducing healthcare costs, and increasing productivity. These programs often include activities like fitness challenges, nutrition workshops, and mental health resources to support overall well-being.

Tailoring Benefits for Employee Attraction and Retention

- Offer flexible coverage options to accommodate diverse employee needs.

- Provide access to telemedicine services for convenient medical consultations.

- Incorporate incentives for participation in wellness programs, such as gym memberships or health screenings.

- Communicate clearly about available benefits to ensure employees understand and appreciate their coverage.

Compliance and Legal Considerations

When it comes to offering health insurance as a small business, there are important legal requirements and compliance standards that must be followed to ensure the well-being of employees and avoid penalties.The Affordable Care Act (ACA) is a significant piece of legislation that has had a major impact on small business health insurance plans.

It introduced various provisions aimed at expanding coverage, controlling costs, and improving the quality of care. Small businesses need to understand how the ACA affects their health insurance offerings and make sure they are in compliance with its regulations.

Overview of the Affordable Care Act (ACA)

The ACA requires small businesses with 50 or more full-time employees to offer health insurance coverage to their employees or face penalties. It also includes provisions such as the establishment of health insurance marketplaces where small businesses can shop for coverage and access tax credits to help offset the costs.

- Small businesses with fewer than 50 full-time employees are not required to provide health insurance but can choose to do so to attract and retain talent.

- Under the ACA, health insurance plans must meet certain minimum standards, including covering essential health benefits and not imposing annual or lifetime limits on coverage.

- Small businesses can explore different options for providing health insurance, such as purchasing coverage through the Small Business Health Options Program (SHOP) marketplace.

Staying Informed and Avoiding Penalties

Staying informed about changing regulations is crucial for small businesses to avoid penalties and ensure compliance with the law. Here are some strategies to help small businesses stay on top of regulatory changes:

- Regularly review updates from the Department of Labor, the Internal Revenue Service, and other relevant agencies to stay informed about changes to health insurance requirements.

- Consult with legal or HR professionals who specialize in healthcare compliance to ensure that your business is following all necessary regulations.

- Consider joining industry associations or groups that provide resources and support for small businesses navigating the complexities of health insurance compliance.

- Invest in training for employees involved in benefits administration to ensure they are up to date on the latest regulations and requirements.

End of Discussion

As we wrap up our exploration of small business health insurance plans, remember that making informed decisions can lead to substantial cost savings and better employee satisfaction. By understanding the nuances and options available, small businesses can navigate the complex world of health insurance with confidence and efficiency.

FAQ Resource

What are the key factors small businesses should consider when selecting a health insurance plan?

Small businesses should take into account factors such as cost, coverage options, network of providers, and the needs of their employees when selecting a health insurance plan.

How can small businesses negotiate with insurance providers to save on premiums?

Small businesses can negotiate with insurance providers by exploring different plan options, seeking competitive quotes, and leveraging the potential of a group plan to lower premiums.

What are the legal requirements that small businesses need to adhere to when offering health insurance?

Small businesses need to comply with regulations such as the Affordable Care Act (ACA), which Artikels standards for coverage, eligibility, and employer responsibilities regarding health insurance.